Provide Term Life Insurance In A Fast, Easy and Profitable Way

Meet the ridiculously fast way to write term life insurance. Now you can quote, compare and submit an order in just five minutes. Every feature was designed to minimize the time and effort you invest in making sure your clients get the coverage they need and deserve.

Did you know VIVE is revolutionizing the term insurance business 5 minute online orders, no paperwork, and underwriting offers in as little as 24 hours. Vive also creates a better experience for you and your client. Period.

Watch and Learn How to Begin

How Does Vive Work?

QUOTE, COMPARE AND SUBMIT AN ORDER IN JUST 5 MINUTES.

ACCELERATED UNDERWRITING DECISIONS IN DAYS INSTEAD OF WEEKS.

THE VIVE SCORE. BECAUSE PRICE ISN’T EVERYTHING.

REAL-TIME CASE STATUS AT YOUR FINGERTIPS.

-

Start Your Order

Just enter your client’s information. Then, select the best carrier and product for your client’s needs from our integrated multi-carrier term life platform.

-

Complete Your Order

Vive’s quote engine allows you to immediately determine your client’s AU eligibility across all Vive carriers. If you submit an order for an AU policy, an interviewer will contact your client by phone in 24-48 hours. No exam, blood or medical records are required. Our exclusive Vive Score weighs a variety of parameters above and beyond price to help you explain the relative consumer value of the products. Hover over the score with your cursor, and you’ll see an instant display of the factors that yield the score. Upon your order submission, both you and your client will immediately receive an email confirmation.

-

Vive Transmits Your Order Directly to the Carrier and J.L. Thomas – Another Vive Exclusive!

Carriers give daily status updates accessible by both you and J.L. Thomas. Thanks to that shared data, we’ll always be on the same page with your cases.

-

Track Your Orders in Vive’s Case Status Portal

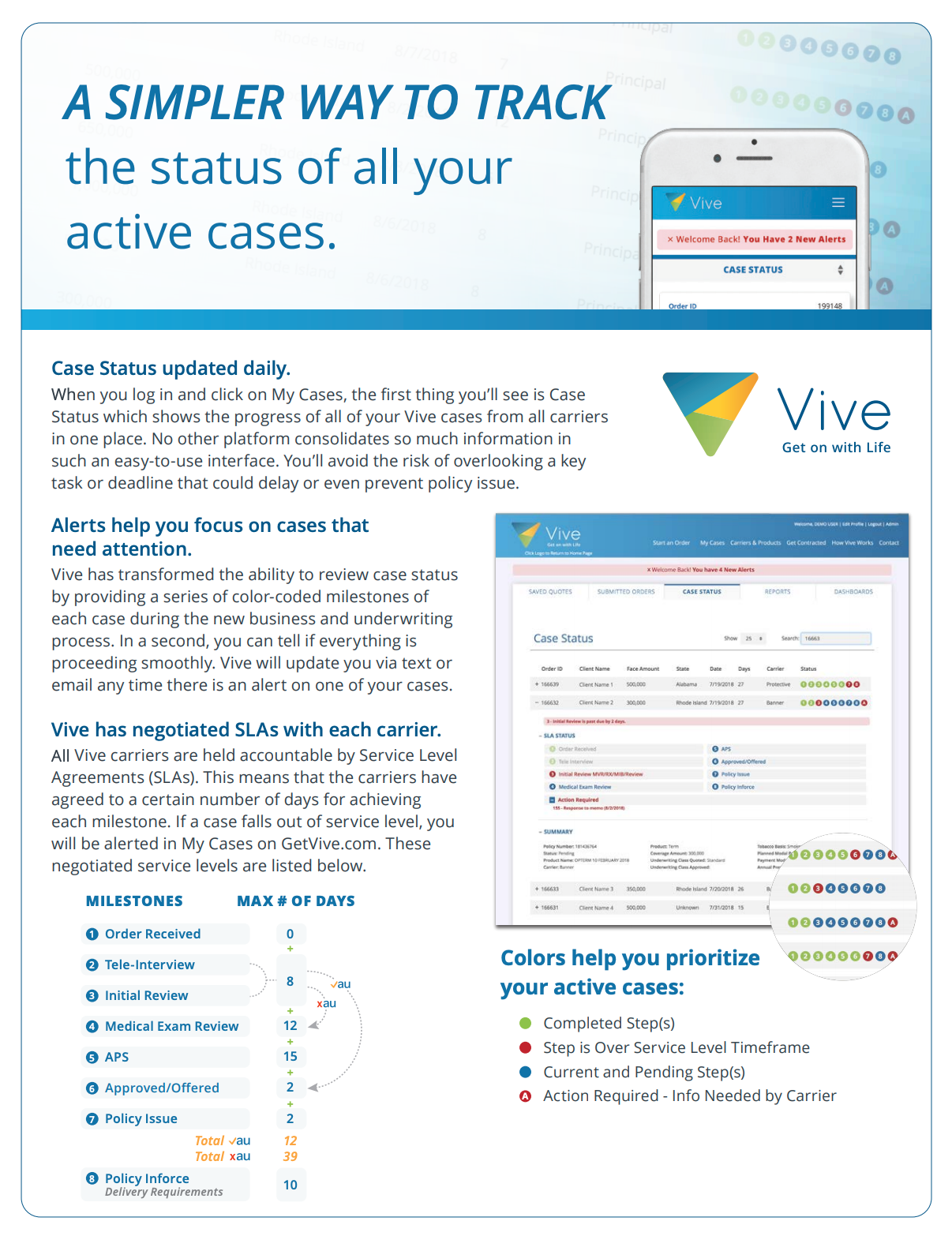

You can track all of your orders on Vive’s case status portal when you log in. Helpful status icons tell you where each case is in the new-business, underwriting and approval process. Case status alerts appear on the site and can be sent to you automatically via text or email.

-

Underwriting Decisions, Policy Issue, and Commission Payment

Vive facilitates the fastest underwriting offers, allowing you to place policies sooner and receive commissions more quickly.